The Future is Green

Are you ready to ride the unstoppable wave of change?

Explore with us:

- Climate change disruptions and opportunities

- ESG investing

- The multi-billion-dollar Carbon Credits ecosystem

Seize the Opportunity

A tidal wave of government and corporate investments is flooding into this revolutionary sector. Early adopters stand to make substantial profits by embracing the green revolution.

This market opportunity is a once-in-a-generation event, poised to become the focal point of investing for decades to come. Think Bitcoin in the early 2010s, tech stocks in the early 2000s, or oil in the early 1900s.

- Trusted by thousands of businesses across countless industries

You're Early to the Scene

This is just the beginning of the journey towards Net Zero, and you’re among the first on the scene – the true innovators in Rogers’ technology adoption curve.

But before we dive in, let’s revisit some basic elementary school science.

- Global Carbon Compliance Market: Mandated by governments, this market is already worth $100+ billion today.

- Voluntary Carbon Market: Valued between $750 million and $1.5 billion, this market has enormous growth potential.

The Carbon Market is Set to Go Ballistic in Size

"Making" Carbon Credits

Ever wondered how carbon credits are created?

- Government Emission Programs: Governments create credits to limit emissions for each company within their jurisdiction. Enter the world of “Cap-and-Trade” programs, where corporate emissions are capped, and surplus credits can be traded.

- Physical Removal of Carbon: Credits can also be generated by physically removing carbon from the atmosphere, presenting an innovative avenue for sustainability.

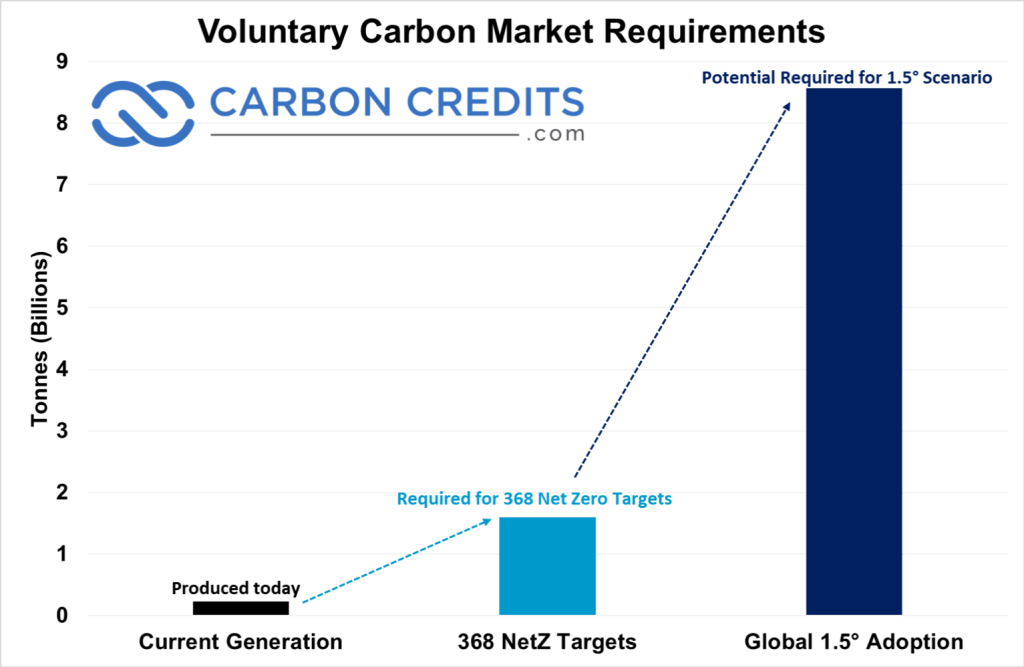

This leaves a requirement of 1.6 billion tonnes worth of carbon credits in the voluntary carbon market for just this one part of the private sector to achieve “net zero”.

Can the voluntary market handle that kind of volume?

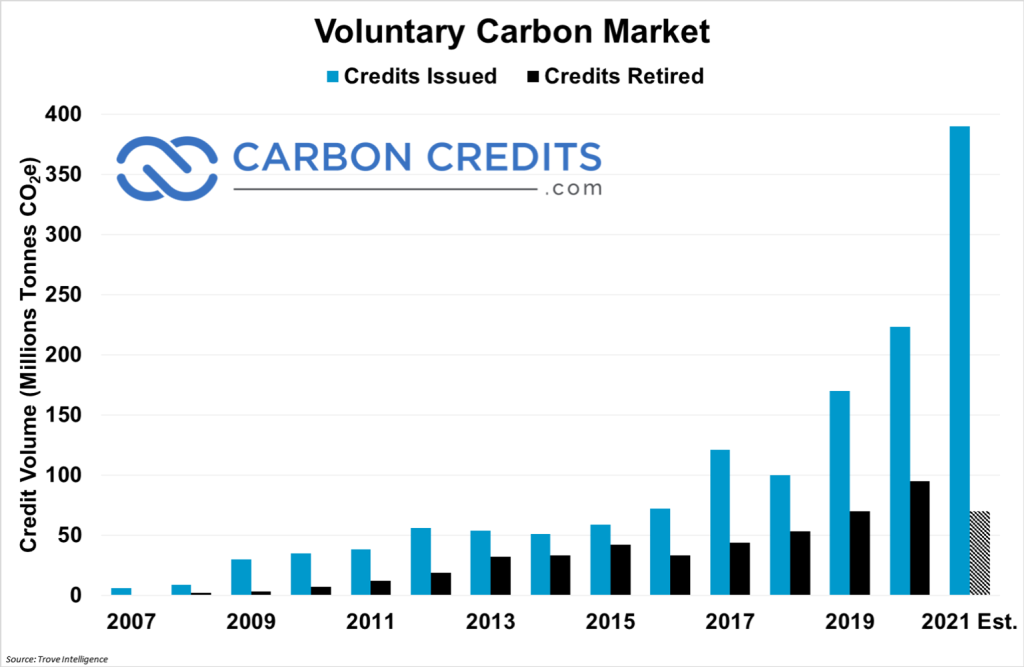

Not yet. Below you’ll see a chart which shows the annual credit generation from carbon offset projects in the voluntary carbon market.

In 2020, annual credit production in the voluntary carbon market was a record 223 million tonnes.

Comparing these 223 million credits generated last year…

To the 1.6 billion tonnes in demand demonstrates the optionality and growth potential of this market. As you can see from the chart, explosive growth is already projected for 2021, with an estimated 390 million credits to be generated – that’s 75% year-on-year growth.

And remember, that 1.6 billion tonnes of demand only accounts for those 368 companies which have currently pledged net zero.

Corporate demand in the voluntary carbon market has the potential to grow by an order of 700% on the low side, and 3,800% on the high side, over the coming decades.

- Trusted by thousands of businesses across countless industries

Carbon Credits are an International Marketplace

Investments Created For Legacy Investors

Ready To Build A Lasting Legacy?

- Trusted by thousands of businesses across countless industries